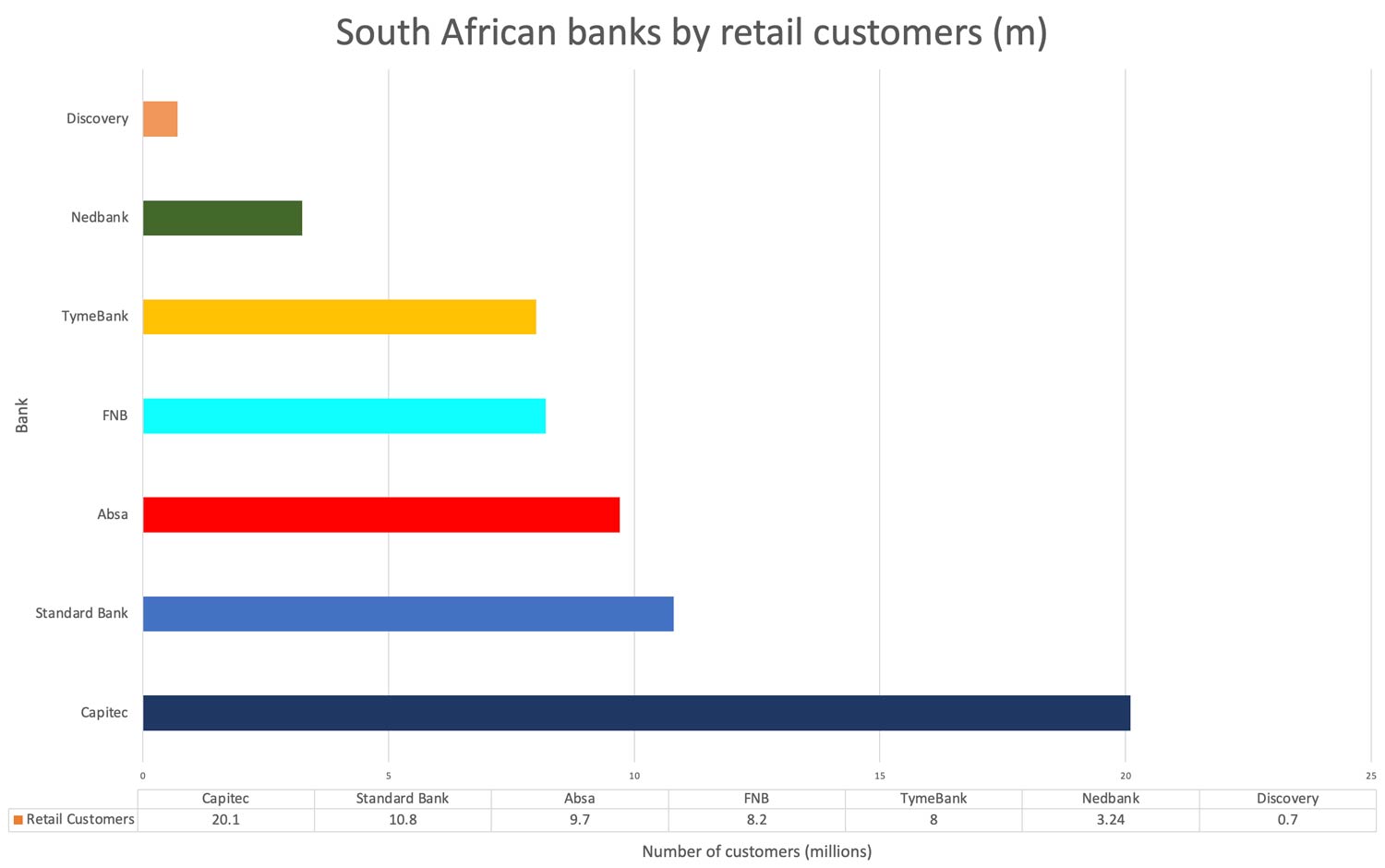

Newcomers to South Africa’s banking industry – brands such as TymeBank, Discovery Bank and Bank Zero – are cannibalising retail markets previously “owned” by the traditional “big four” banks. And they are just getting started.

Last week, TymeBank announced it had signed up its eight millionth customer, a feat the digital bank achieved just four years after its 2019 launch.

And yet these challenger banks are not confining themselves to the retail sector in their quest for market share. Some have started to launch business offerings in the latest threat to traditional, branch-based institutions.

“Given the economic pressures we are facing, South African consumers are a lot more price conscious – no matter the income segment. This makes affordability a really strong differentiator,” said Cheslyn Jacobs, chief commercial officer at TymeBank, explaining why the company — controlled by Patrice Motsepe’s African Rainbow Capital Investments — has been successful in signing up so many retail clients.

For consumers, savings on fees for deposits, withdrawals and other transactions are one attraction of the new banks. Another is better interest rates on savings and deposits. Jacobs said TymeBank has managed to garner a sizeable portion of the consumer market by offering the “the best savings rates (up to 11%)” on top of a cost-effective banking suite.

“We expect continued customer growth and for our proposition increasingly to appeal to the more affluent customers as more South Africans demand banking that is affordable, without compromise,” said Jacobs.

Commercial banking

The drive towards better value for consumers in retail banking is now shifting to commercial banking, which is far larger than the retail segment in terms of revenue. Challenger banks have taken notice and are now starting to target this market, too.

“Business customers at Bank Zero make up 12% of customer volumes; this is a higher percentage than traditional banks,” said Bank Zero co-founder and executive director Lezanne Human. “One of the reasons is that in the past, most banks focused mainly on the personal segment when differentiating on lower pricing and innovative functionality, neglecting the business segment. Differentiation in the business segment focused mostly on new products. That was a big gap in the market, which we were able to address.”

Read: Revealed: how much South Africa’s big banks spend on IT

Much of the success that some challenger banks have achieved can be attributed to price differentiation, said Human. This is because these would-be disruptors usually take aim at the lower end of the market, where customers are price sensitive. The ability to deliver innovative products of value at low cost has, however, proven to have benefits beyond attracting the intended target market.

Traditional banks are not blind to the threat posed by the digital-first banks. Over the years, they have responded with significant investments into their own digitisation efforts. They have also introduced accounts with lower fees.

In a recent interview with TechCentral, Sanlam Fintech CEO Riaan van Dyk said it’s difficult, culturally, for legacy banks to transition from the old to the new paradigm. Yet it’s necessary for them to make this transition to shield them from disruption by newcomers.

“It is very difficult to change the way you look at the world and how you do things while you are running a successful business. It’s like trying to change the wings of an aeroplane in-flight,” Van Dyk said.

However, it’s not as if traditional banks haven’t been responding with sophisticated digital offerings of their own.

A key difference, said Bank Zero’s Human, must be noted here, though: while digitisation is a strong strategic pillar for challenger banks, not all of them can claim to be fully digital. A digital-first model allows them to offer their services at much lower cost because they do not have to maintain expensive legacy systems on which the traditional banks were built and which they still rely.

Read: Why SA banks still issue cards with magstripes

“The reality is, if internal costs are low, then the revenue we get from investing ‘lazy deposits’ as well as card interchange received and commission on prepaid products is more than sufficient,” said Human. “Our internal costs are low because we used new technology to build our own core banking platform and we are not burdened by expensive and clunky legacy systems that cost a lot to buy and to maintain.”

Some digital challenger banks are also edging into private banking, taking them into a potentially lucrative space. Although this may not bode well for the incumbents, it is likely that consumers will benefit from the disruption in ways similar to the mass market retail sector: with more choice and downward pressure on pricing. — (c) 2023 NewsCentral Media