Cell C, South Africa’s long-struggling mobile telecommunications operator, has provided insight into its financial performance and promised significant improvements in the coming years following a strategic overhaul.

“The company’s business stabilisation efforts are yielding improved results, positioning it to return to growth and enhanced competitiveness in the market,” it said in a statement on Monday.

Cell C will host several media and analyst engagements on Monday, and TechCentral will bring its readers full coverage of the financial results throughout the day. In the interim, the initial statement from Cell C on its financial performance is pasted below.

Statement in full

Cell C published a trading update for its operational performance for the period from January to September 2023 (YTD September 2023) and July to September 2023 (Q3 2023), as well as its audited numbers for FY22 and FY21.

The company’s business stabilisation efforts are yielding improved results, positioning it to return to growth and enhanced competitiveness in the market.

This year has been a rebasing year for Cell C. Despite operating in a challenging landscape, exacerbated by load shedding, Cell C’s business demonstrated resilience by maintaining the revenue position of R10.09-billion (YTD September 2023) versus R10.14-billion in 2022.

Read: Blue Label seeks new strategic investor for Cell C

The Average Blended Revenue Per User (Arpu) for the consumer base has increased from R74 in 2022 to R80 by the end of September 23 due to an increase in high-quality subscribers. Cell C has now aligned to the industry norm of reporting on consumer Arpu, which is a combination of prepaid and post-paid service revenue. Previous reporting had been at net revenue and inclusive of other revenues outside of consumer.

Our direct expenses have increased by 7% year on year, the main driver being the finalisation of the network transition in June 2023. As at September 2022, the network transition progress was at 65%. The increase in the roaming costs has a direct impact on the gross margin, which also shows a reduction of 23%. This will continue to be a difference between Cell C and the balance of the industry.

The focus to prioritise key performance indicators has begun to yield results with Q3 2023 reflecting a growth trajectory in revenue and continued cost management. This entailed driving the return to growth and profitability, leveraging the improved network quality and creating awareness with customers on the better connectivity. This was further buoyed with embedding a culture of execution excellence, building staff and stakeholder confidence.

As a result, Q3 2023 saw overall revenue growth of 1.5%, amounting to R50-million, compared to Q3 2022. This increase has been driven by improved execution for prepaid and continued growth in wholesale, post-paid and equipment sales. Q3 2023 has been the first quarter in 2023 where Cell C is showing revenue growth versus prior year.

While Q3 2023 was a rebasing of performance, the FY2022 audited numbers reflect a business in transition, which includes the impact of the recapitalisation process that started on 30 September 2022.

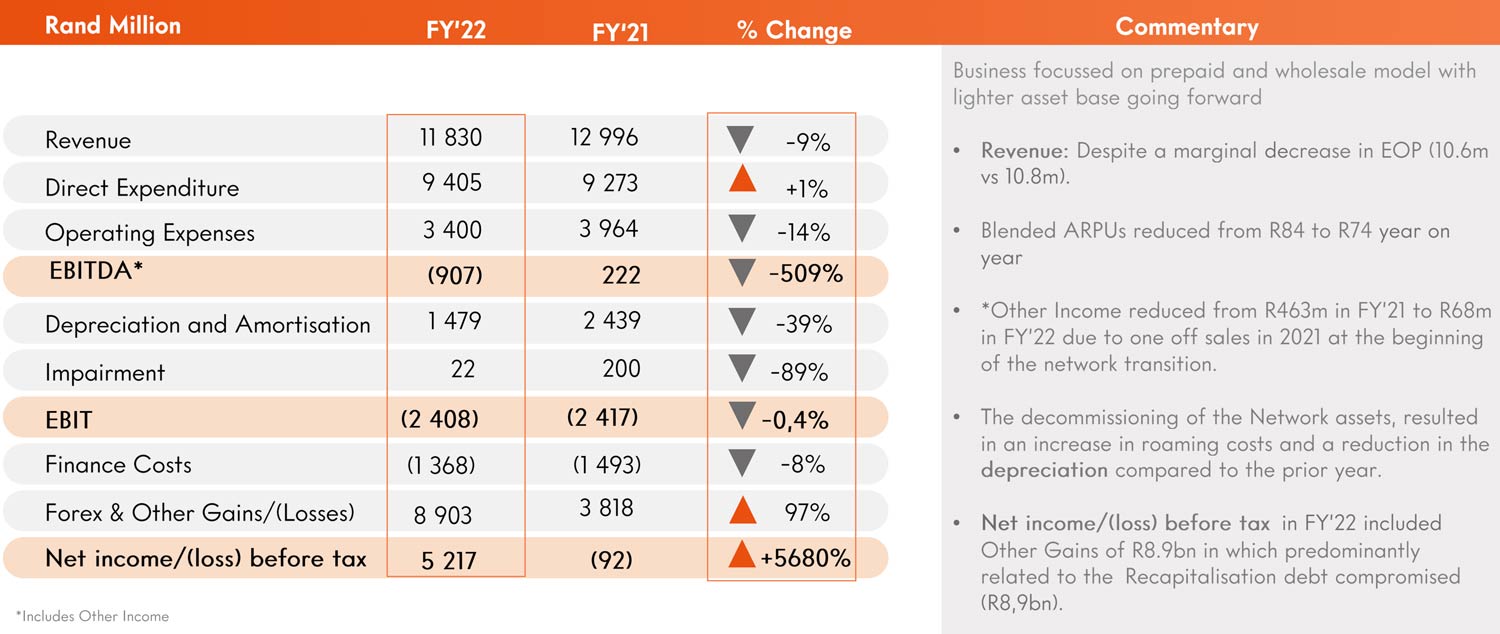

Revenue declined by 9% in FY2022 compared to FY2021 despite a marginal increase in the customer base in 2022. The network transition implemented in line with Cell C’s capex-light operating model resulted in an increase in roaming costs. Despite the increase in direct costs, the gross margin percentage improved from 29% in 2021 to 30% in 2022 due to a change in product mix.

Ebitda, or earnings before interest, tax, depreciation and amortisation, reduced by 509% due to revenue reduction, the continued evolution of direct expenditure in line with the network transition plan and lower operating costs. A declining asset base due to the network transition reduced site operating expenses within operating expenses.

Net profit before tax ended at R5.2-billion in 2022. The main drivers of the movement have been the recapitalisation and the continuation of the network transition. Depreciation reduced by 39% year on year, in line with the network transition, with material impairments having occurred in 2021.

Finance costs

Although the recapitalisation included debt restructure, the financing costs remained high in 2022 as recapitalisation only occurred in September 2022. The large once-offs in 2022 in other gains relate to the recapitalisation impact. A benefit of R8.9-billion was realised due mostly to the debt concessions related to recapitalisation. The other gains would not repeat in 2023 as these relate to the recapitalisation transaction.

The objective of recapitalisation to reduce debt has been achieved with interest bearing debt moving from R9-billion to R3-billion. Property, plant and equipment decreased by R1-billion because of the network transition and resultant decommissioning of network assets. The lease concessions have also contributed to deleveraging the balance sheet. We have also issued an effective 11% of shares as part of the recapitalisation transaction which changed Cell C’s shareholding. Overall negative equity improved year on year but remained negative on 31 Dec 2022 and is expected to remain at these levels until the business turnaround is completed.

TCS | Levy brothers on the future of Blue Label and Cell C

“With our newly formed management team, building a great culture, a fully operational network and a robust strategy, Cell C is well positioned to drive growth and profitability. We have implemented several strategic initiatives to drive revenue generation and reverse the struggling performance we experienced in the past,” said Cell C CEO Jorge Mendes.

Cell C is confident that the reduction of its asset base in line with the capex-light model will allow Cell C to focus on driving profitable growth in the future.

Cell C is confident that the reduction of its asset base in line with the capex-light model will allow Cell C to focus on driving profitable growth in the future.

Mendes said Cell C remains committed to providing high-quality telecoms services and enhancing customer experiences. “I am pleased that in the last quarter of 2023 we are seeing improved performance momentum. By leveraging our robust network infrastructure, we aim to capitalise on growth opportunities in the market and deliver sustainable performance in coming years.”