There are many parallels between French broadcasting giant Groupe Canal+ and South Africa’s MultiChoice Group, which is now firmly in the former’s sights.

There are many parallels between French broadcasting giant Groupe Canal+ and South Africa’s MultiChoice Group, which is now firmly in the former’s sights.

There are similarities in the companies’ roots, developmental pathways and their responses to changes in the premium broadcasting landscape, which, over the years, have led to them dominating their respective markets.

The convergence point for the two companies is Africa, viewed by many as the next – and perhaps last – frontier of growth for broadcasting services.

In many ways, Canal+ is to French Africa what MultiChoice has become to the English-speaking nations on the continent, and its eyes are now set on dominating the entire region.

“Canal+ is a global media company with a presence in more than 50 countries across Europe, Africa and Asia. It has a long and proud history of investing and operating in Africa, having been present on the continent for over 30 years and directly serves eight million African consumers,” Groupe Canal+ in a statement on Thursday in which it announced its desire to acquire MultiChoice Group.

Both companies started life as premium subscription channels in the mid-1980s. Canal+, Groupe Canal+’s flagship channel, went live in November 1984, while M-Net, the forerunner to the DStv satellite service, was launched in 1986. Both offerings now boast a catalogue of more than 200 channels each, ranging from general entertainment to sports, news, reality TV and more.

Digital satellite television

In the mid-1990s, both companies were frontrunners in the digital satellite television boom, with MultiChoice serving South Africa and Canal+ France. While its major market has historically been South Africa, MultiChoice quickly expanded elsewhere in Africa, mostly in Anglophone nations. During the same period, Canal+ was making inroads into Europe, South America and Francophone Africa. Today, its African operation, managed through its Canal+ Afrique subsidiary, spans 23 countries including Burkina Faso, Cameroon, Ghana and the Ivory Coast.

With the continent neatly divided along linguistic lines, the broadcasters employed similar strategies to maintain dominance in their respective markets. Investments in localised content, which MultiChoice and Canal+ sometimes collaborate on, have been key to growing market share. But the acquisition of sporting rights, often exclusively, has perhaps been the main selling point for both pay-TV operators – a position that is now potentially under threat as global streaming giants begin to eye live sports as their next growth engine.

Read: Why Canal+ wants control of MultiChoice

The rise of internet-based streaming platforms as the preferred medium for viewing content has attracted several deep-pocketed international players into the growing African market. The increased competition threatens to dethrone MultiChoice and Canal+ as the de facto acquirers of the rights for Africa. The downstream effects could even threaten their pay-TV operations in their entirety.

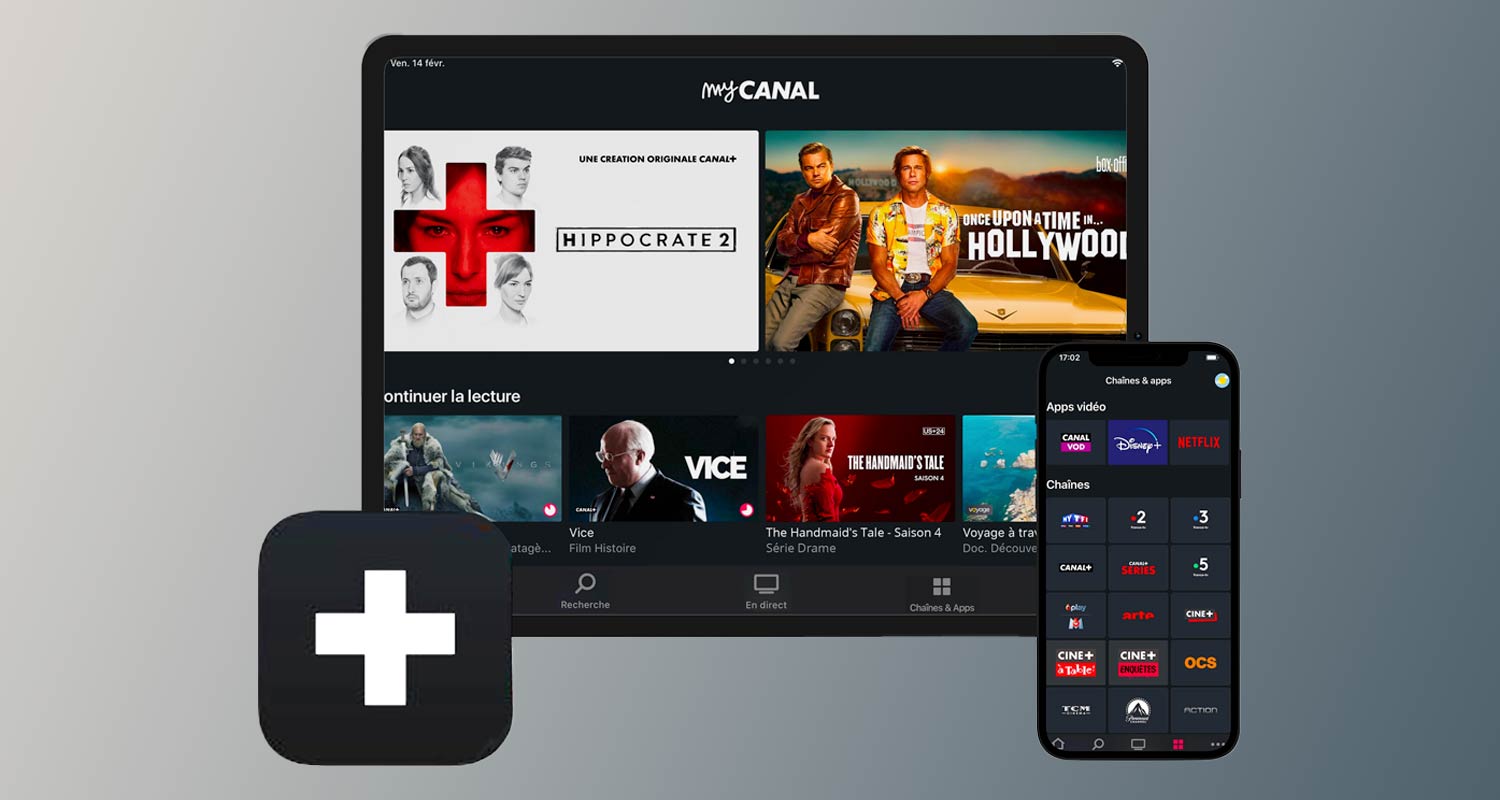

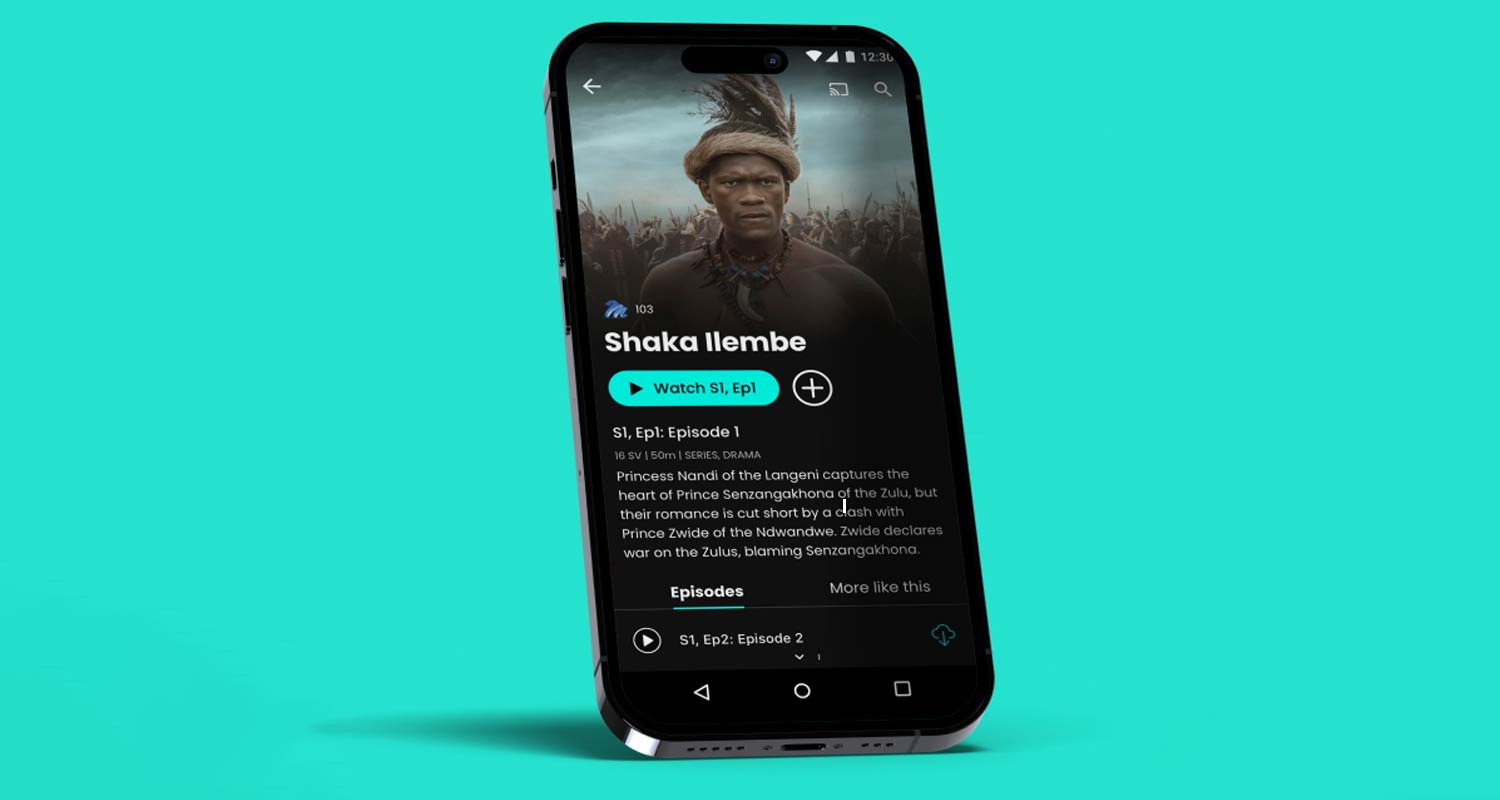

Not surprisingly, both companies have responded to the threat by building similar services of their own. Canal+ simply has an app that replicates its satellite TV services via the internet, called myCanal Afrique, which was launched in 2020. MultiChoice has employed the same strategy through its DStv Now offering (now DStv Stream), but also launched a pureplay streaming service called Showmax, the second version of which was built in partnership with US-based broadcaster Comcast and launched last month.

Canal+’s relationship with Vivendi Group, its holding company, was initiated through a merger in 2001. Vivendi holds a number of large media assets that include mobile games publisher Gameloft, video-sharing platform Dailymotion as well as the advertising and PR firm Havas.

Canal+’s relationship with Vivendi Group, its holding company, was initiated through a merger in 2001. Vivendi holds a number of large media assets that include mobile games publisher Gameloft, video-sharing platform Dailymotion as well as the advertising and PR firm Havas.

In December, Vivendi announced restructuring plans that would, if successfully concluded, result in the unbundling and separate listing of Canal+. French newspaper Le Monde reported (article in French) that the plan, which could take up to 18 months to conclude, would see Vivendi transformed into an investment holding company.

Read: Showmax costing up to R3.3-billion to relaunch

MultiChoice went through a similar process that culminated in its unbundling from former parent Naspers in 2019 and subsequent listing on the JSE. The move, which partly represented a change in strategic direction for Naspers, also had a positive “value unlocking” effect for both group’s shareholders.

“Canal+ is actively preparing its listing following the unbundling announcement of its parent company Vivendi. This will allow investors to benefit from the combination of Canal+ and MultiChoice, our ultimate goal being to also obtain a listing in South Africa,” Canal+ said in its Thursday statement.

Joining forces makes sense for the broadcasters, which could use their combined resources to outmuscle competitors in the scramble for Africa. Deeper collaboration between the two entities, through shared infrastructure and the transfer of expertise, could decrease costs and improve margins while boosting localised content production for both entities.

However, South Africa’s restrictions on foreign ownership of broadcasters could still prove to be an insurmountable hurdle in the way of Canal+’s ambitions. – © 2024 NewsCentral Media