Standard Bank Group on Thursday reported a 14% jump in software, cloud and technology-related costs, blaming the higher spending on cloud migration and software licences.

Standard Bank Group on Thursday reported a 14% jump in software, cloud and technology-related costs, blaming the higher spending on cloud migration and software licences.

“Personalisation” and “focused AI-driven projects” also contributed to the rise in IT spending, the group said in notes alongside its financial results for the year ended 31 December 2023.

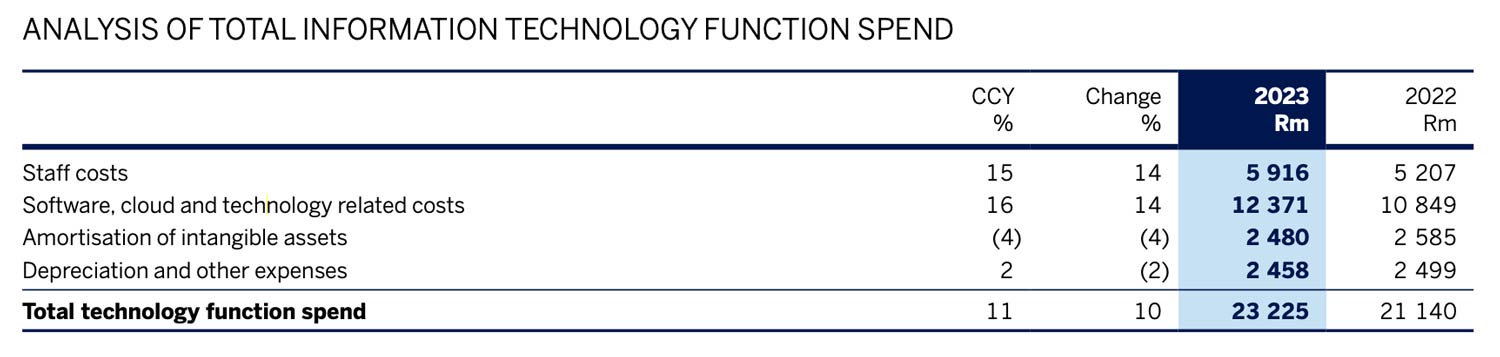

Software, cloud and technology-related costs – previously referred to as IT costs – jumped to R12.4-billion, from R10.8-billion in the same period in 2023, Standard Bank said.

Including staff costs of R5.9-billion – which also rose by 14% year on year, from R5.2-billion previously – the 2023 full-year operating costs related to IT, excluding amortisation, depreciation and other expenses, climbed to R18.3-billion (see table below).

Amortisation declined by 4% as the group’s large, historic IT programmes started to “roll off”.

Specific factors that contributed to the increase in operating expenses related to technology investments included:

- The depreciation of the rand against the US dollar, which negatively impacted software licensing costs;

- A shift to demand-based system utilisation by migrating to the cloud and software services, which improved operational efficiency and the group’s ability to scale; and

- Continued investment in the security and stability of the group’s IT systems.

“System stability and availability was excellent throughout the year,” Standard Bank said.

Bad loans

Overall, the banking group said annual profit jumped by 27% as high interest rates helped offset rising bad loans.

The lender posted full-year headline earnings of R42.9-billion, while total net income grew by 20% to R177.6-billion, driven by net interest income growth of 25% and non-interest revenue growth of 13%.

The top five private South African banks, including Standard Bank are generally known to have well-capitalised balance sheets and conservative lending practices.

But inflationary pressures, high interest rates, regular load shedding and logistical bottlenecks are taking a toll on their most sensitive retail and small business customers, leading to defaults.

Standard Bank said credit impairment charges increased by 22% to R16.3-billion, which pushed its credit loss ratio – a measure of bad loans as a percentage of total loans – up to 98 basis points from 83bps and close to the upper range of its target of 100bps. As a result, total provisions increased by 15% to R64-billion.

The group’s loans and advances grew by 7% to R1.7-trillion as strong growth in corporate and sovereign lending offset subdued retail lending growth together with a decline in business lending.

Read: South Africa stands to win big from open banking

“Our clients are likely to remain constrained until interest rates start to decline,” the bank said. It said credit impairment charges were expected to peak in the first half of 2024, driven primarily by ongoing strain in personal and private banking.

Meanwhile the credit loss ratio is expected to remain within the target but near the top of its range. – © 2024 NewsCentral Media, with additional reporting by Nqobile Dludla, © 2024 Reuters