New data on the South African banking sector yields intriguing insights into the industry’s standing in terms of customer sentiment and operational efficacy.

New data on the South African banking sector yields intriguing insights into the industry’s standing in terms of customer sentiment and operational efficacy.

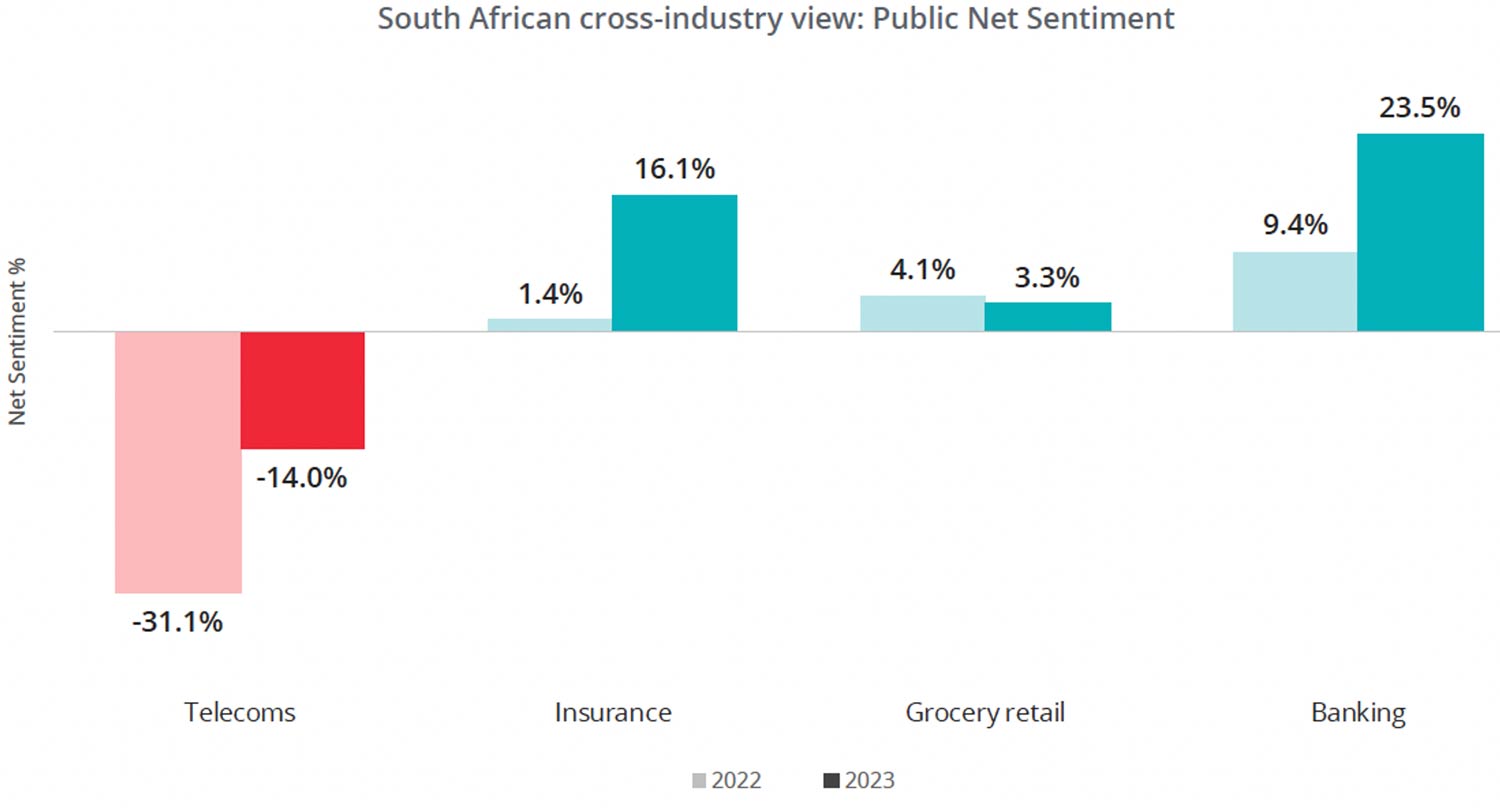

DataEQ’s eighth annual South African Banking Sentiment Index analysed more than 4.3 million social media posts in the year to 31 August 2023 and it shows a striking leap in the banking industry’s “net sentiment”. Sentiment analysis detects a customer’s reaction to a product, brand, situation or event through texts, posts, reviews and other digital content. Using sentiment analysis, business leaders can gain insight into how their customers think and feel.

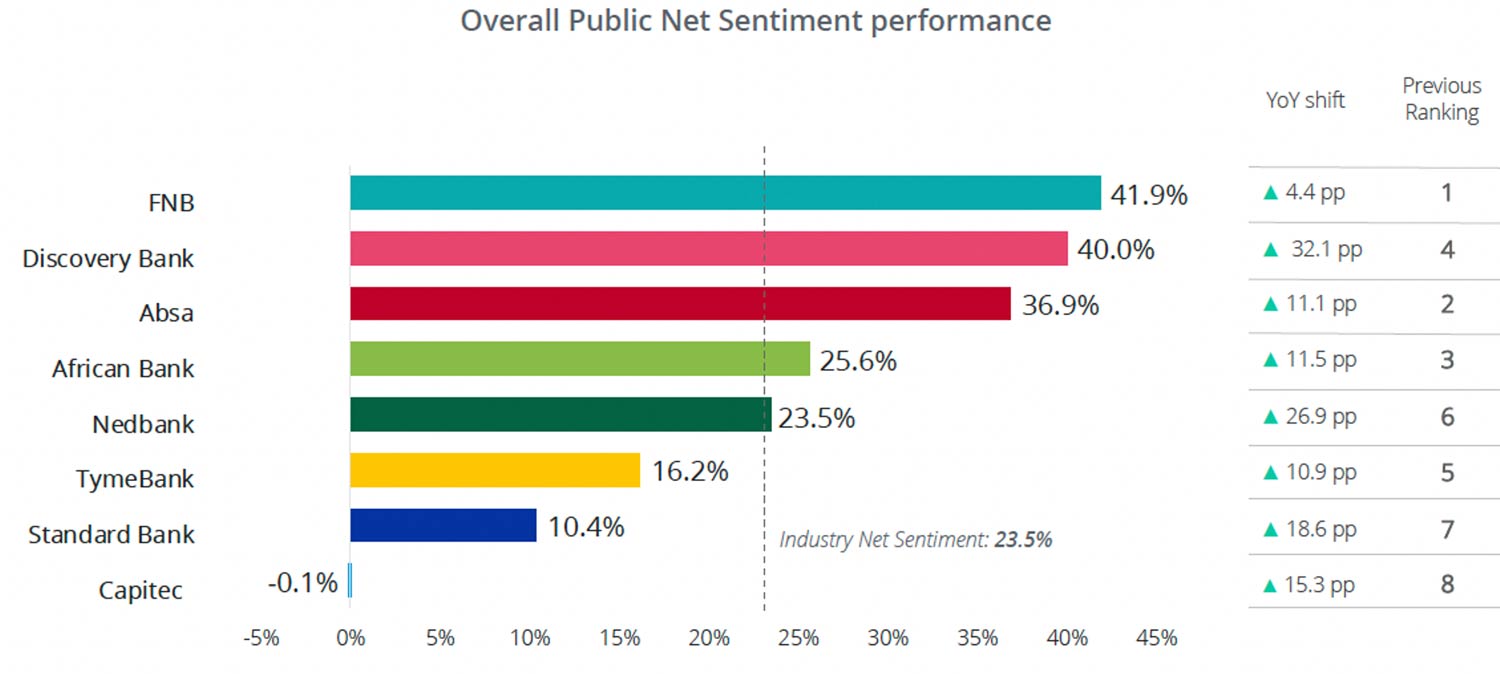

The data, encompassing posts related to African Bank, Absa, Capitec, Discovery Bank, FNB, Nedbank, Standard Bank and TymeBank, shows a rise in net sentiment from 9.4% in 2022 to an impressive 23.5% this year, marking the highest compliment-to-complaint ratio among the four regions analysed by the company.

Positive net sentiment results for the South African and Kenyan banking industries contrasted sharply with the results seen in the UK, where negative mentions comprised nearly half of all online conversations, resulting in an overall net sentiment of -25.6%.

FNB held onto its leading position from the previous year’s index to lead the pack by just under two percentage points. FNB achieved the highest net sentiment score in customer service and surpassed industry benchmarks in staff competency, with more than a third of its positive feedback coming from compliments about staff at the bank’s branches.

Customers also appreciated FNB’s approach to contactless billing and payment services, including the bank’s e-wallet service, tap-to-pay feature and ability to create virtual cards for secure transactions. FNB was recognised by Global Finance as South Africa and Africa’s best digital bank in 2023.

Discovery Bank

Positioned second, Discovery Bank’s 32 percentage point increase this year came from strategic promotional efforts. Positivity towards the brand was largely driven by campaigns that promoted the bank’s app and rewards, offering features like Vitality Travel for discounted flights, real-time payment system and integration with virtual card systems such as Samsung Pay and Apple Pay.

Ranking third, Absa’s success in net sentiment is largely attributed to its campaigns such as #WeDoMoreWednesdays and #FreeAbsaRewards. These initiatives have effectively highlighted the bank’s affordability and rewards scheme, bolstering its reputational sentiment.

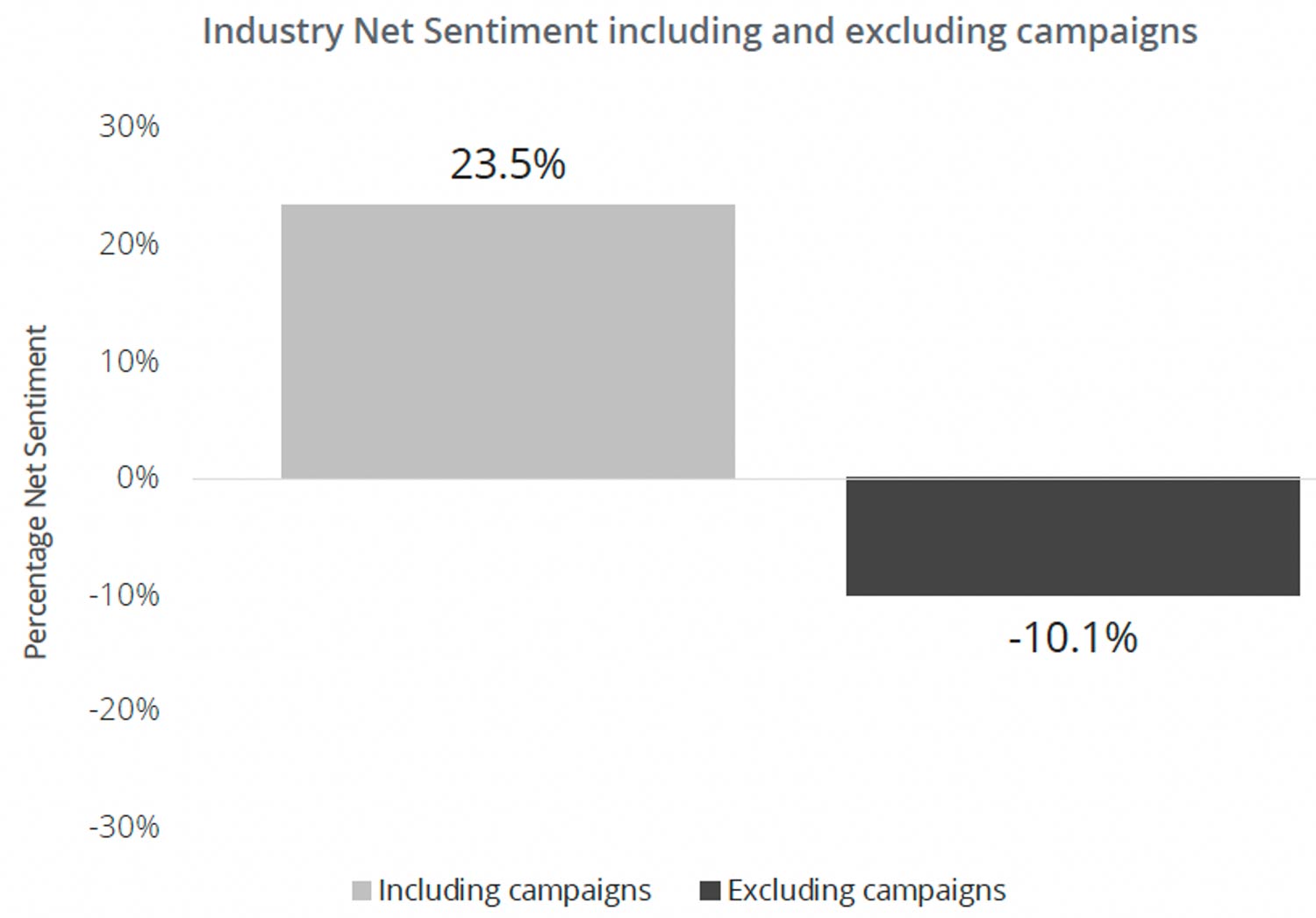

The banking industry’s effective use of campaigns influenced net sentiment, as many campaigns used savvy strategies to elicit positive feedback from consumers around certain products. Evidence of this is the comparative 33 percentage point decline in net sentiment when campaign-related mentions were excluded from the analysis.

“It’s truly encouraging to see how the banking industry has continued to record a positive net sentiment for the second year in a row, and that this figure grew by 2.5x since last year’s index,” said DataEQ banking lead Sarah Lamb.

“This growth reflects a significant shift towards content and campaigns that genuinely resonate with consumers, and it’s clear that banks are being more favourably received. However, successful campaigns can sometimes mask underlying operational challenges. The industry faces ongoing challenges in transaction delays, platform accessibility and customer service responsiveness, specifically at overburdened call centres.” — © 2023 NewsCentral Media